Same change, different industry

Last week, Totango discussed Customer Retention Cost (CRC) at their annual Customer Success Summit in San Francisco. Their new measure helps SaaS companies compare the costs of battling churn and growing installed base revenue. The metric, however, harkens to another industry and an earlier time. Like their predecessors, cloud computing executives can use the benchmark to track a fundamental change.

Cost assessment

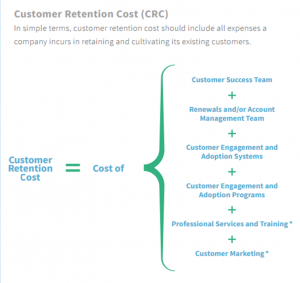

Customer Success technology provider Totango defines CRC as the cost of onboarding and serving customers after acquisition.[1] The measure includes labor, technology and marketing expenditures incurred for retaining and growing subscription revenue. It gives greater visibility to costs that would otherwise be mingled into corporate overhead. CRC is used to derive ratios such as Annual CRC/Customer, Average Lifetime CRC/Customer, and CRC Ratio (Annual CRC/Annual Revenue). These calculations help executives determine how much to invest in retention. For example, numbers from the Pacific Crest Survey indicate that across the industry, CRC averages about 12% of sales. Providers can now use this figure as a rough benchmark for comparison.[2]

Customer Success technology provider Totango defines CRC as the cost of onboarding and serving customers after acquisition.[1] The measure includes labor, technology and marketing expenditures incurred for retaining and growing subscription revenue. It gives greater visibility to costs that would otherwise be mingled into corporate overhead. CRC is used to derive ratios such as Annual CRC/Customer, Average Lifetime CRC/Customer, and CRC Ratio (Annual CRC/Annual Revenue). These calculations help executives determine how much to invest in retention. For example, numbers from the Pacific Crest Survey indicate that across the industry, CRC averages about 12% of sales. Providers can now use this figure as a rough benchmark for comparison.[2]

Shades of the past

The new metric is strikingly similar to one used for years by manufacturers: Cost of Poor Quality (COPQ). A brainchild of IBM quality expert James Harrington in 1987, COPQ defines the economic impact that could occur if systems, processes, and products were perfect.[3] It further categorizes costs of quality assurance and improvement activities:

- Failure—costs of scrap, rework, repair, returns, warranty obligations, etc.

- Appraisal—costs of measurement, inspection and test

- Prevention—costs to improve processes and product designs

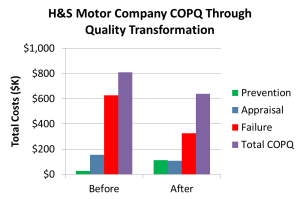

While COPQ can serve as a benchmark (ranging from less than 5% to more than 30% of sales in some firms), its real value comes from tracking the effects of continuous improvement over time. Manufacturers have learned that refining processes and designs upstream prevents quality problems from occurring downstream. For example, H&S Motor Company adopted total quality principles and saw dramatic bottom line impact over four years.[4] Operating costs dropped while revenue increased, shrinking COPQ from 19% to 10% of sales. During their quality transformation, H&S found that a fourfold increase in Prevention activities led to 50% lower Failure costs. Appraisal costs dropped modestly as well since there were fewer defects to detect. H&S’ results mimic those experienced by thousands of manufacturers adopting the same quality improvement approach.

While COPQ can serve as a benchmark (ranging from less than 5% to more than 30% of sales in some firms), its real value comes from tracking the effects of continuous improvement over time. Manufacturers have learned that refining processes and designs upstream prevents quality problems from occurring downstream. For example, H&S Motor Company adopted total quality principles and saw dramatic bottom line impact over four years.[4] Operating costs dropped while revenue increased, shrinking COPQ from 19% to 10% of sales. During their quality transformation, H&S found that a fourfold increase in Prevention activities led to 50% lower Failure costs. Appraisal costs dropped modestly as well since there were fewer defects to detect. H&S’ results mimic those experienced by thousands of manufacturers adopting the same quality improvement approach.

Cloud computing parallels

Customer defection is to cloud computing what production defects are to manufacturing. Both incur significant financial loss—Totango’s survey indicates two-thirds of SaaS companies lose more than 5% of their customers every year.[5] And like manufacturing flaws, customer churn is driven by a failure to do things right the first time. In SaaS companies, poorly conceived value propositions, bad customer targeting, inappropriate deals, confusing user interfaces, buggy software, unresponsive support, fumbled implementations, inadequate onboarding, and failure to develop strong customer attachments can all contribute to high operating costs and lost revenue.

But cloud computing has unique challenges. Unlike hard goods manufacturing, SaaS companies constantly revise and upgrade their software and services, continually changing their value. Manufacturing’s production lines are easily seen, but cloud computing leaders must reveal their “hidden factories” in software development, customer acquisition and service delivery. And in contrast to transactional businesses, subscription companies must actively build trusting relationships and grow their installed base revenue to compensate for churn. Besides analyzing why customers leave, cloud companies must also learn what makes them stay, buy more and refer others.

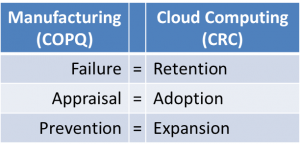

Despite their differences, cloud computing companies appear destined to repeat the history of the manufacturing sector. To increase financial performance, cloud computing must also become more proactive, adopting approaches like Lean Six Sigma and strategic management systems to improve products and processes. They will learn that high performance is achieved through better up-front product, competitive strategy and customer experience design, not by detecting and fixing problems later. As they grow in organizational maturity, companies will naturally redeploy their assets much like H&S did, but in cloud computing shifting resources from retention to expansion instead of failure to prevention.

Despite their differences, cloud computing companies appear destined to repeat the history of the manufacturing sector. To increase financial performance, cloud computing must also become more proactive, adopting approaches like Lean Six Sigma and strategic management systems to improve products and processes. They will learn that high performance is achieved through better up-front product, competitive strategy and customer experience design, not by detecting and fixing problems later. As they grow in organizational maturity, companies will naturally redeploy their assets much like H&S did, but in cloud computing shifting resources from retention to expansion instead of failure to prevention.

Change awaits

As Totango CEO Guy Nirpaz said at last week’s conference, SaaS companies must play to win, concentrating on revenue growth. But in order to do that, companies must first retain the customer base they seek to grow. Unfortunately, most of today’s SaaS companies aren’t ready to play at that level. In fact, only 10% of investment in Customer Success is currently dedicated to expanding revenue from a happy customer base.[6] It’s clear that the ideal strategy to play offense instead of defense depends on SaaS companies first transforming themselves just like their predecessors did in manufacturing. Perhaps the new metric will be as influential as COPQ in driving change within the industry. By highlighting costs and tracking the shift in investment from reactive to proactive, CRC will undoubtedly tell a similar story along the way.

Sources:

[1] Mulla-Feroze, K. (2015) The Missing SaaS Metric: Customer Retention Cost, Totango Corp. publication.

[2] Skok, D. (2014) 2014 Pacific Crest Saas Survey- Part 2; accessed 3/26/15

[3] Harrington, J. (1987), Poor-Quality Cost, American Society for Quality, ISBN 978-0-8247-7743-2, OCLC 14965331

[4] Russell, R., and Taylor, B. (2010) Operations Management: Creating Value along the Supply Chain, Seventh Edition. Wiley, ISBN-13: 978-0470525906

[5] 2014 Totango 4th Annual SaaS Metrics Survey Report; accessed 3/27/15.

[6] Technology Services Industry Association